Higher for Longer After All? Investors See Fed Rates Falling More Slowly.

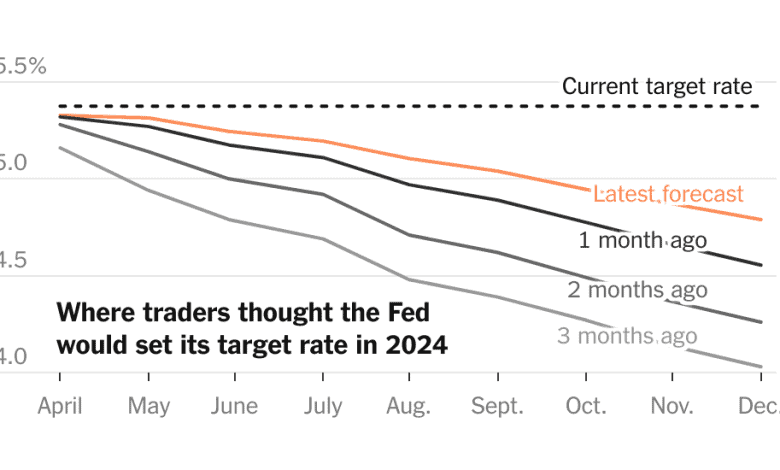

Investors were betting big on Federal Reserve rate cuts at the start of 2024, wagering that central bankers would lower interest rates to around 4 percent by the end of the year. But after months of stubborn inflation and strong economic growth, the outlook is starting to look much less dramatic.

Market pricing now suggests that rates will end the year in the neighborhood of 4.75 percent. That would mean Fed officials had cut rates two or three times from their current 5.3 percent.

Policymakers are trying to strike a delicate balance as they contemplate how to respond to the economic moment. Central bankers do not want to risk tanking the job market and causing a recession by keeping interest rates too high for too long. But they also want to avoid cutting borrowing costs too early or too much, which could prod the economy to re-accelerate and inflation to take even firmer root. So far, officials have maintained their forecast for 2024 rate cuts while making it clear that they are in no hurry to lower them.

Here’s what policymakers are looking at as they think about what to do with interest rates, how the incoming data might reshape the path ahead, and what that will mean for markets and the economy.

What ‘higher for longer’ means.

When people say they expect rates to be “higher for longer,” they often mean one or both of two things. Sometimes, the phrase refers to the near term: The Fed might take longer to start cutting borrowing costs and proceed with those reductions more slowly this year. Other times, it means that interest rates will remain notably higher in the years to come than was normal in the decade leading up to the 2020 pandemic.

When it comes to 2024, top Fed officials have been very clear that they are primarily focused on what is happening with inflation as they debate when to lower interest rates. If policymakers believe that price increases are going to return to their 2 percent goal, they could feel comfortable cutting even in a strong economy.